An Update on Excise Taxes for Electronic Nicotine Delivery Systems (ENDS) Across the United States

Reports suggest the e-cigarette market to grow at an annual rate of nearly 29 percent and reach a $168 billion valuation by 2030. As a big part of the future for the tobacco industry, electronic nicotine delivery systems (ENDS) are having their moment in state legislatures across the United States as governments look to regulate and get their share of revenue from excise taxes. Whether you or your clients have been selling ENDS for years or are looking to enter new markets, we have an overview of the regulatory issues that could arise when it comes to tax reporting and licensing.

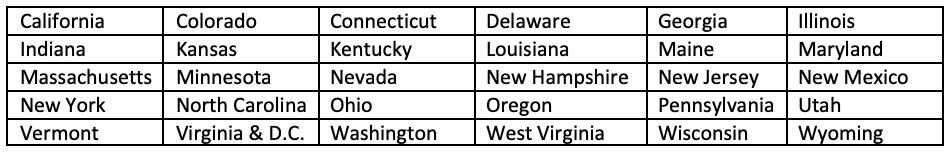

Which States Have a Tax on ENDS and Other Vape Products?

In 2015, only three states plus the District of Columbia had an excise tax on vapor products, but that number has since grown to 30 with the following states in the below table passing legislation in some form. If you have a multi-state operation, odds are that your ENDS are subject to some type of tax or regulation in at least one state.

Could More States Pass ENDS Taxes During the 2023 Legislative Sessions?

While 20 other states do not currently have a separate excise tax on ENDS, that could quickly change as many state legislatures have introduced bills that could (or will) become law in the coming years. Here is a list of the 2023 bills circulating in other states that would introduce various taxes and licensing requirements on the sale or distribution of ENDS and related products:

- Alaska SB 89

- Hawaii SB975

- Idaho HB199

- Iowa HB21

- New Mexico HB124

- South Carolina HB3548

- Texas SB339

- Virginia SB1350

Do Tobacco Distributors and Retailers Need a Separate License to Sell ENDS?

Each state has the power to create its own rules and licensing requirements for businesses that want to legally sell ENDs and vapor products within its borders. Some states simply lump ENDS into pre-existing licenses for selling other tobacco products (OTP) or cigarettes, but other states have separate licenses for dealers of vapor products. In some jurisdictions, you may see a combination of both depending on if you are a distributor or retailer.

For example, Ohio has a separate license for distributors that only sell vapor products but offers a combined license for distributors that sell both vapor products and OTP. Additionally, retailers do not need an additional license for selling vapor products if they already have an OTP license. In comparison, Texas has a separate retailer permit necessary for businesses that sell e-cigarettes. Before selling tobacco or ENDS products in a state, it is essential to confirm licensing obligations to avoid forfeiture of product as contraband, civil fines, and criminal charges.

How Do the State Excise Taxes on ENDS Work?

Taxes on ENDS, vapor products, and e-cigarettes can all vary from state to state. However, most states that have a tax impose it in one of two ways, both of which are similar to traditional tobacco products taxes. One method is to base the tax as a percentage of the wholesale sales price. Alternatively, states may impose the tax on a per unit basis. For example, Virginia has a tax of 6.6 cents per milliliter of liquid nicotine sold.

Are Vapor Products That Don’t Have Nicotine Subject to Excise Tax?

If your vapor and ENDS products contain nicotine, including synthetic nicotine, they are almost certain to trigger excise tax obligations. However, products without nicotine may not be subject to tax depending on the jurisdiction. For example, California’s CECET permit and excise tax applies to electronic cigarettes sold with nicotine but specifically excludes electronic cigarettes that are FDA approved as a tobacco cessation product. In comparison, Georgia includes alternative nicotine products within its excise tax on e-cigarettes and vapor products.

Key Issues in Vapor Product Sales Compliance and Tax Refund Opportunities

Aside from the nicotine levels in your ENDS, other factors could also influence whether excise tax applies to their distribution or retail sale. For example, the following issues could affect how, and if, your vapor products are taxable:

- How you package the products for retail purchase (i.e., an integrated unit versus devices separated from nicotine cartridges).

- The types of liquids or substances being vaporized or heated electronically.

- The nature of the cartridge (e.g., open, closed, or disposable).

- The type of product being sold (e.g., a component part or a disposable nicotine cartridge).

Depending on your state’s rules, it is easy to potentially overpay on your e-cigarette and vapor product taxes by accidentally charging tax on items that are not taxable. Keeping detailed records of your inventory, invoices, and other transactions is essential for defending your tax compliance and seeking refund opportunities when available.

For all your tobacco and e-cigarette tax or licensing needs, schedule a free consultation with our team of professionals today.